HM Revenue & Customs on X: "Are you looking for a new job this National Careers Week? Use the HMRC App to instantly check your National Insurance number, income and tax code. #

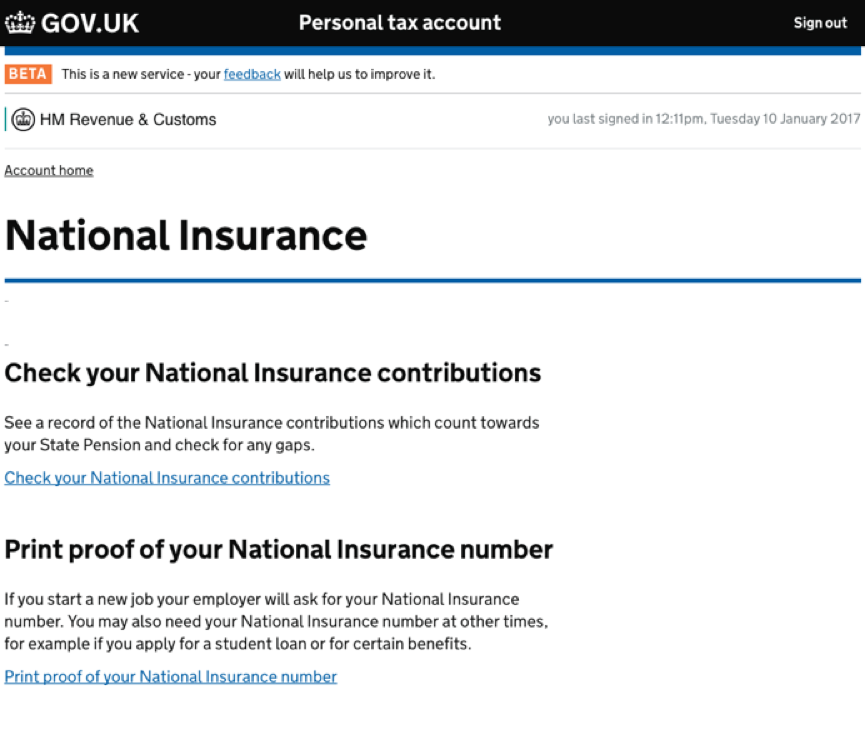

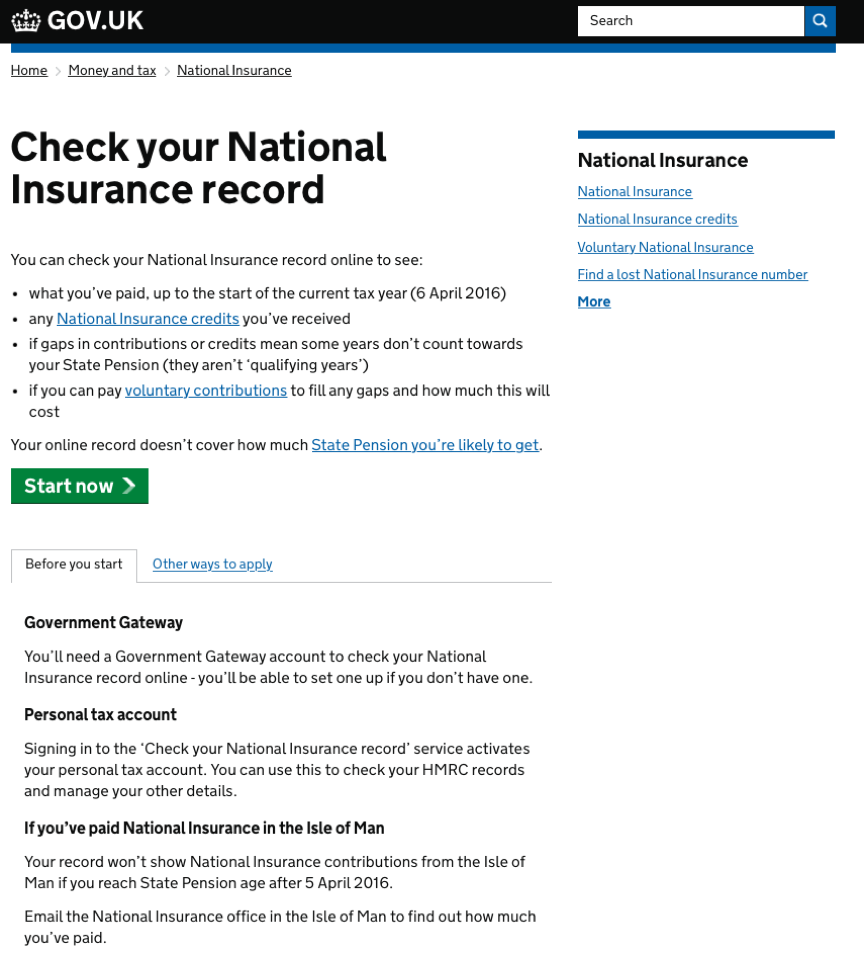

Medical Training Initiative (UK) and CPSP Scholarship Program: How to get your UK National Insurance Number

Exclusive: Now 9.8 million men over 60 had their national insurance contributions paid by the state | Westminster Confidential

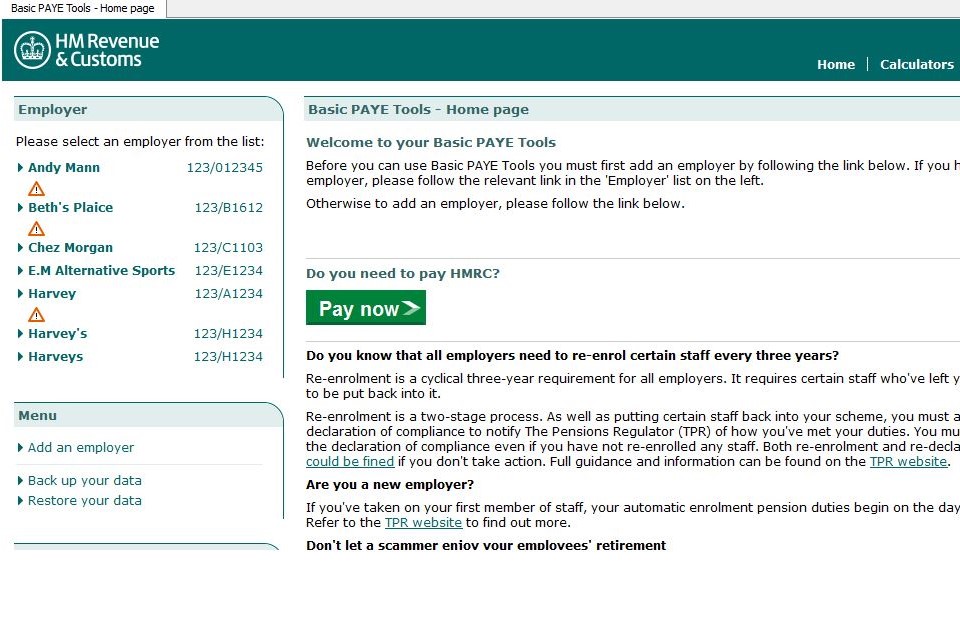

HMRC updated guidance: NI, PAYE and income tax — Mascolo & Styles | Bookkeeping & Outsourced Payroll | Alton & Hampshire UK

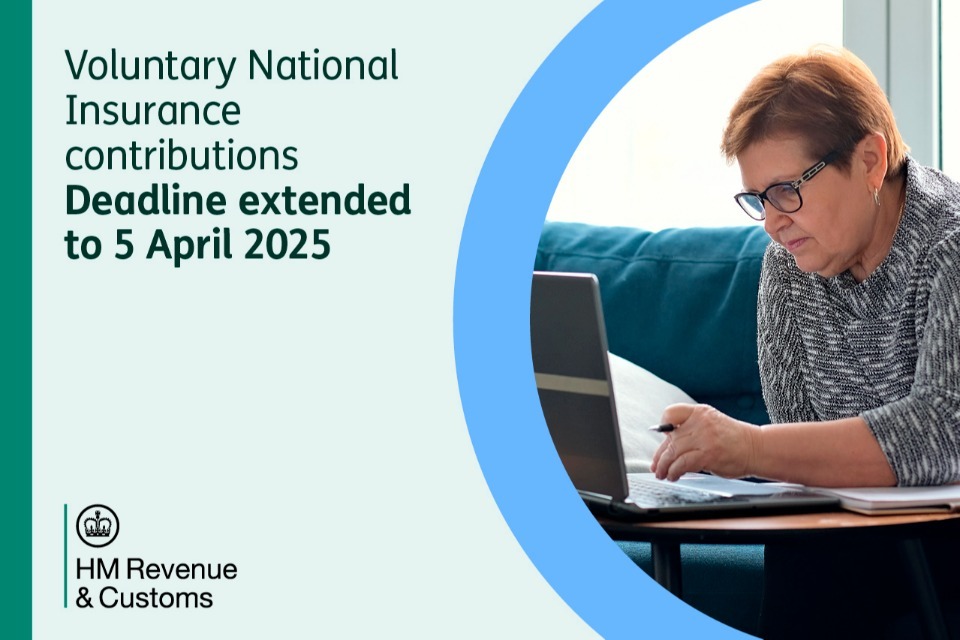

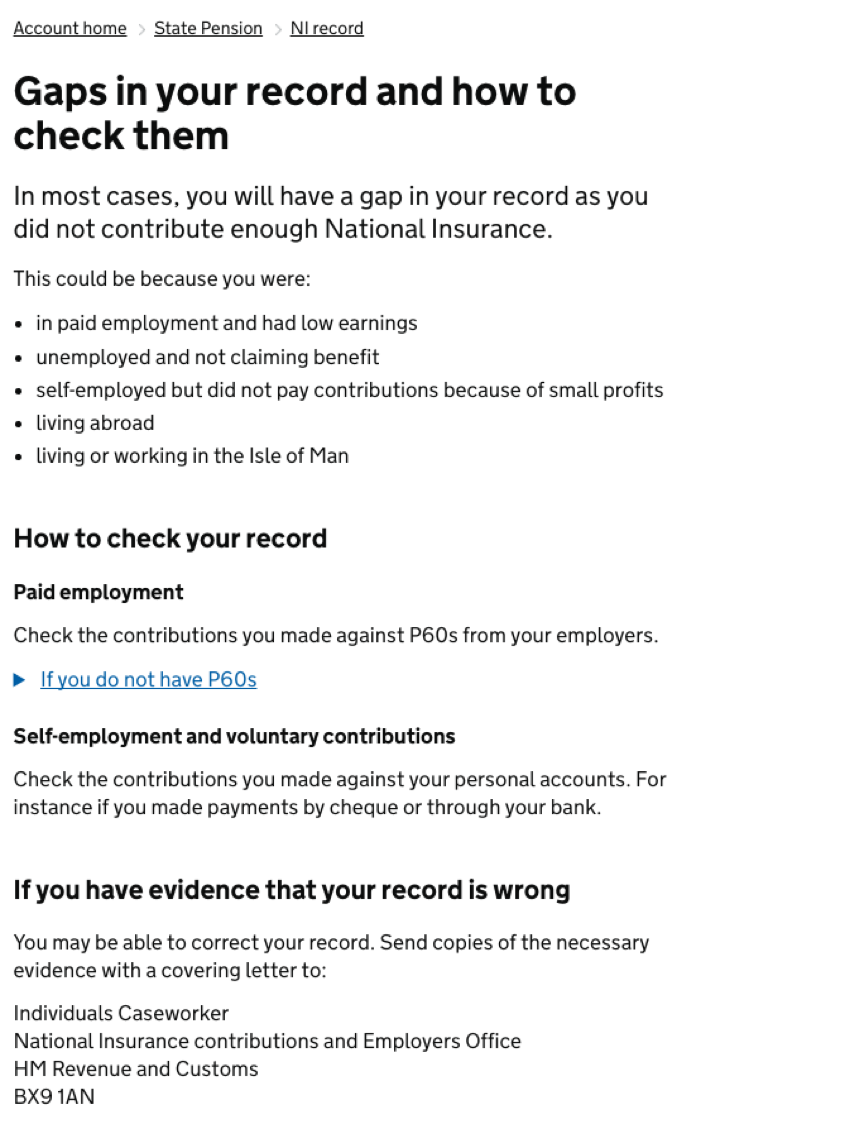

Why would you want to make voluntary payments to HMRC? | Payroll Options posted on the topic | LinkedIn

HMRC: Taxpayers given more time for voluntary National Insurance contributions – The NEN – North Edinburgh News

Information from HMRC - Self-employed Class 2 National Insurance contributions (NICs) due Stock Photo - Alamy

HMRC - From 6 July, National Insurance thresholds are changing, so you pay National Insurance contributions on less of your income. Find details on GOV.UK. A new calculator gives a broad estimate

Charging national insurance at 12% on all employees, including those earning over £50,000 a year, could raise £14 billion of extra tax a year